Introduction

Pantomath Capital Management Private Limited (“PCMPL”) along with its holding, subsidiary, affiliates, and sister concerns together referred as “Pantomath Group”. Pantomath Group is an Indian Investment management & financial services provider and a SEBI registered Merchant Banker.

At Pantomath Group, we acknowledge that all our stakeholders can have an impact on the environment and community, and therefore we comprehend and endorses the need for adherence to environmental, social, and governance policies consistent with our values by all parties associated with us. We believe that an ESG policy and an effective ESG management system will guide us to identify potential Environment, Social and Governance (ESG) risks early on when planning for an investment.

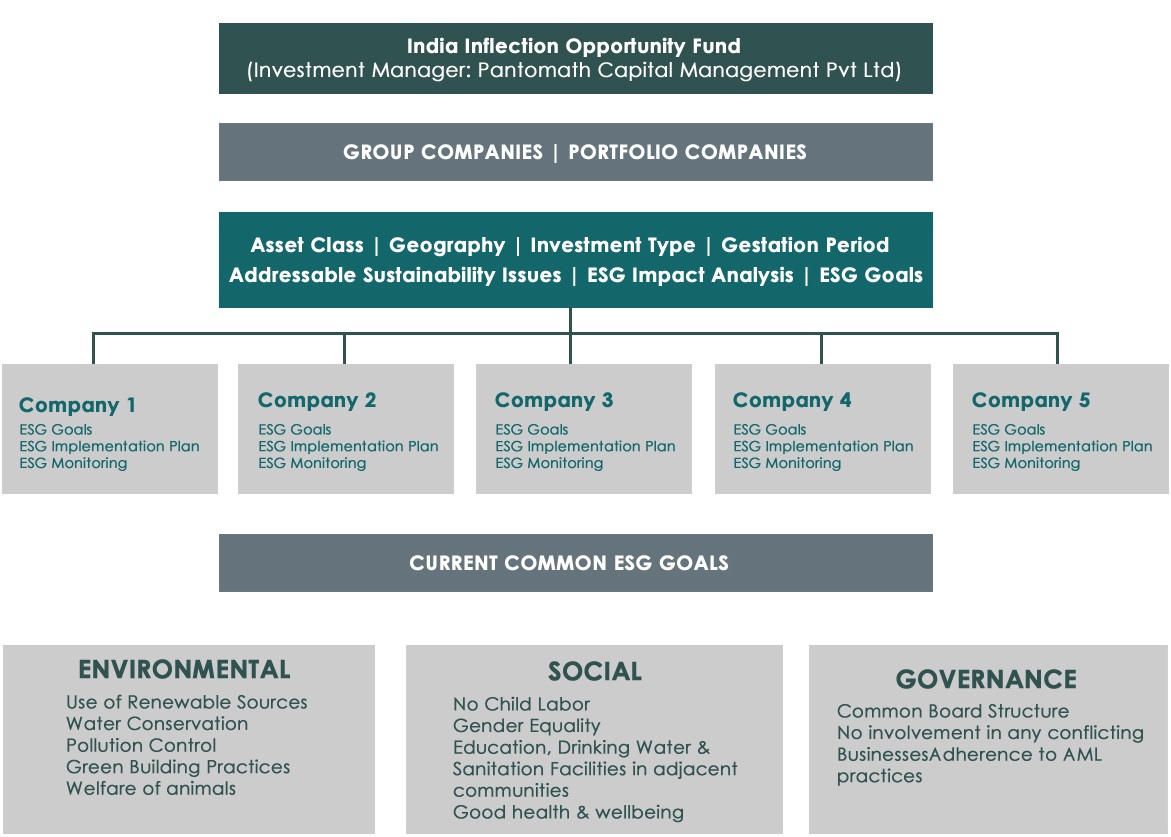

Pantomath Group intends to integrate ESG considerations in all stages of its investment decision making to leverage on any potential opportunities because of better environmental and social performance and governance principles of investee companies and mitigate related risks. The key components of the ESG management framework are illustrated and described further in this document

ESG Policy Statement

This Environmental, Social and Governance (“ESG”) Policy defines Pantomath Capital Management Private Limited’s (“PCMPL”) approach to assessing ESG risks and value creation opportunities related to investments being considered or made by its investment funds (“Funds”). Pantomath Group considers material ESG matters in the course of its due diligence and management of portfolio investments for its Funds to the extent reasonably practical in a given circumstance.

For the purposes of this ESG policy, material ESG issues are defined as those issues that Pantomath Group in its sole discretion determines have or have the potential to have a direct substantial impact on an organization’s ability to create or preserve economic value as well as environmental and social value for itself, the communities where it operates, and other stakeholders.

Examples of ESG matters include :

- Environmental: energy use and efficiency, carbon emissions, pollution, and waste and water management;

- Social: human rights, equality, health and safety, community impacts; and

- Governance: management and board structure, anti-money laundering and conflicts of interest.

As a long-term investor, we believe we have a fiduciary obligation to proactively address ESG risks and opportunities as part of our investment strategy to create long-term sustainable value for Pantomath Groups’ companies, associates, investors, limited partners, portfolio companies & clients.

Our ESG Commitment

- Consider environmental, governance, safety and social issues associated with potential investment opportunities in Pantomath’s evaluation of the prospective entity or asset and the ongoing asset management of the portfolio investment.

- Continually engage with relevant stakeholders, including, but not limited to, local communities, First Nations and all levels of government, either directly or through representatives of portfolio companies, as appropriate, to communicate on ESG matters and priorities.

- Actively develop and improve the long-term sustainability of portfolio investments for the benefit of multiple stakeholders.

- Work with partners, management of portfolio companies, contractors and stakeholders to the extent reasonably possible to improve and advance ESG initiatives at Pantomath and its portfolio investments.

- Promote transparency and timeliness in communication with stakeholders and Pantomath’s limited partners on ESG matters.

- Follow strict guidelines that prohibit bribery and other improper payments to public officials and follow anti-money laundering laws and regulation globally.

ESG Policy Statement